Preserve Policyholder Protections

Policyholders pay premiums in exchange for a promise from their insurance company that claims will be paid in full and on time. Too often insurers fail to hold up their end of the bargain by unfairly denying, delaying, or underpaying valid claims. That’s why strong laws with stiff penalties – like those that have been codified in the Insurance Code for decades – are necessary to deter bad conduct.

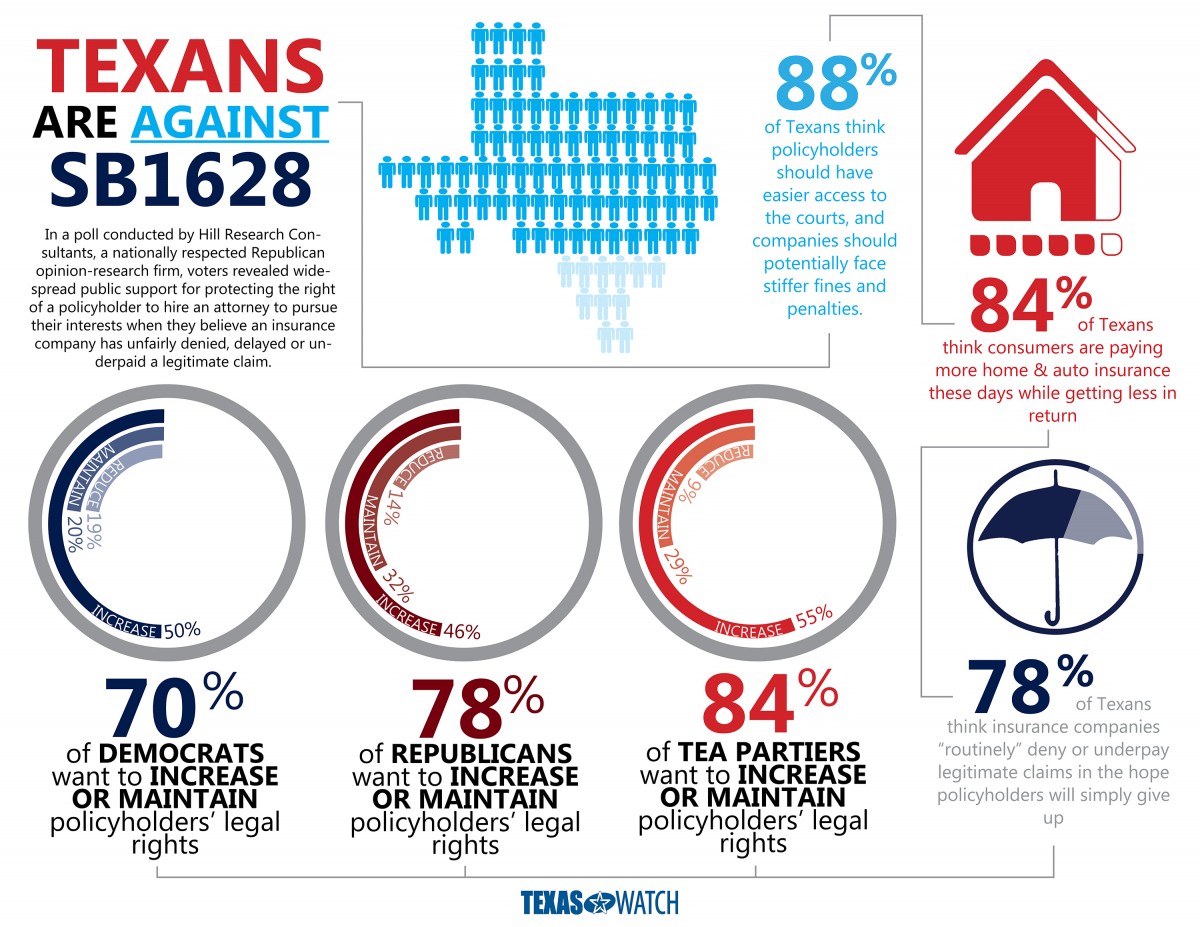

However, Senate Bill 1628 gives to industry and takes from policyholders. This legislation is currently being debated by the Texas Legislature. Take action now to stop this dangerous bill.

Also, share this short video with your friends and family, encouraging them to get involved.

BACKGROUND

Chapter 541 of the Insurance Code protects policyholders from unfair and deceptive trade practices. Chapter 542 ensures claimants are paid on time and in full. Together, the strong penalties codified within these long-standing laws – a full measure of damages under Ch. 541 and 18% interest under Ch. 542 – are the last and most important lines of defense for policyholders. Without them, policyholders – both commercial and individual – face abuse by big insurers without meaningful legal recourse. SB 1628 is an industry wish list, making extensive changes to Ch. 541 & 542, effectively gutting policyholders’ protections. Families and businesses have raised their voices against this bad bill.

Summary of most objectionable provisions: (printable PDF)

- HOLLOWED OUT DAMAGES: SB 1628 incentivizes low and slow pay by insurers.It undermines prompt pay laws by applying penalties to only the “unpaid” portion of the claim (Section 9). Current law is designed to ensure valid claims are paid timely and that policyholders receive full payment under their policy. If an insurer offers to pay 50 cents on the dollar, you can’t put on 50% of a roof. The policyholder either has enough money to make necessary repairs, or the repairs can’t be made. Without receiving policy benefits for which premiums have already been paid, homeowners can’t rebuild, businesses can’t reopen, and people can’t return to their jobs. SB 1628 enables insurers to buy down their liability through legal gamesmanship in the form of insufficient payments, while commercial and individual policyholders are left with devastated properties. A right without a remedy is no right at all.

- EXPANDED IMMUNITY: SB 1628 effectively immunizes industry employees, agents, representatives, and adjusters from the consequences of their misconduct (Section 2). Currently, these people have a legal duty to do right by policyholders. Under SB 1628, they may act without personal responsibility, meaning their financial relationships and employment with insurers will control their findings and dealings. This change also puts Texas citizens and businesses at a disadvantage to out-of-state insurance companies by pushing insurance cases into federal courts, driving up litigation costs and delaying policyholder suits, which will be parked behind federal criminal trials. This “wait-‘em-out” scheme would have the result of pressuring claimants into accepting low-ball settlements. State law claims should stay in state court.

- PENALIZING POLICYHOLDERS: SB 1628 puts commercial and residential policyholders in the crosshairs by creating new “gotcha” provisions, criminalizing innocent mistakes by claimants while immunizing industry misconduct. Current law gives insurers the ability to make qualifying offers of settlement and dismiss non-meritorious claims. However, SB 1628 allows insurers to raise a number of new defenses, including the abatement of property claims on mere technicalities if policyholders do not comply with every last requirement of onerous new notice procedures (Sections 6, 7, 8). Additionally, adjusters who knowingly underestimate damage on behalf of insurance carriers are not penalized under the bill due to the immunity provisions discussed above, while policyholders and their adjusters face criminal penalties for their estimates (Section 19). Importantly, insurers can force a claim, or a part of a claim, into appraisal and escape all liability under Ch. 541 & 542 in doing so, effectively taking away policyholders’ 7th Amendment Right to Trial by Jury (Section 10).

- SHORT CLAIMS DEADLINE: SB 1628 severely restricts the time that claimants have to file a claim. All property damage claims would be subject to a two-year deadline, regardless of when the policyholder discovered – or should have discovered – the damage (Section 10). This ignores the fact that certain structural damage and systems failures inside of walls, closets, and foundations can take time to detect, and landlords may only discover damage after tenants vacate at the end of the lease. The long-standing discovery rule should be preserved for business and individual policyholders.

OPPOSITION TO SENATE BILL 1628

Business Opposition to SB1628 by Texas Watch

TEXAS WATCH STATEMENTS ON SB 1628

TX Senate Chooses Insurance Immunity Over Texas Families & Businesses, April 29, 2015

The Texas Senate gave preliminary approval to the Insurance Immunity Act – SB 1628 – today. After a procedural vote and a few “clean up” amendments expected tomorrow, the bill heads to the Texas House. Following is a statement from Alex Winslow, executive director of policyholder advocacy organization Texas Watch.

Sen. Taylor and TLR Can’t Defent Insurance Immunity Act. So, They’re Attacking Us., April 29, 2015

Sen. Larry Taylor and his allies at TLR want to distract attention from the terrible impact SB 1628 – the Insurance Immunity Act – would have on Texas families and businesses by resorting to direct attacks on Texas Watch. Proponents of SB 1628 know that they cannot defend this bill on its merits. It speaks volumes that rather than debate the merits of the bill, they are making personal attacks.