Accountability

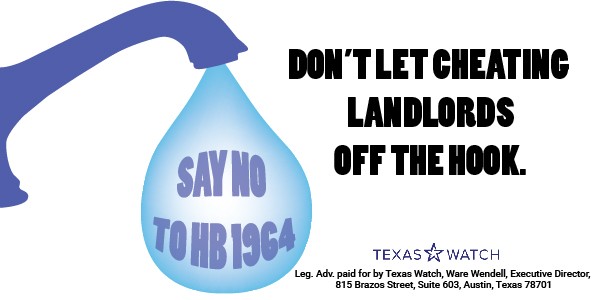

When bad actors put the lives and livelihoods of Texas families at risk, that wrongdoer should be held accountable. This simple concept, immortalized in the Seventh Amendment of our constitution, is under attack. Texans are slowly being stripped of their legal rights in favor of special interests. Texas families and businesses need strong accountability protections that ensure real consequences for bad actors.